New Paycheck Protection Program from SBA

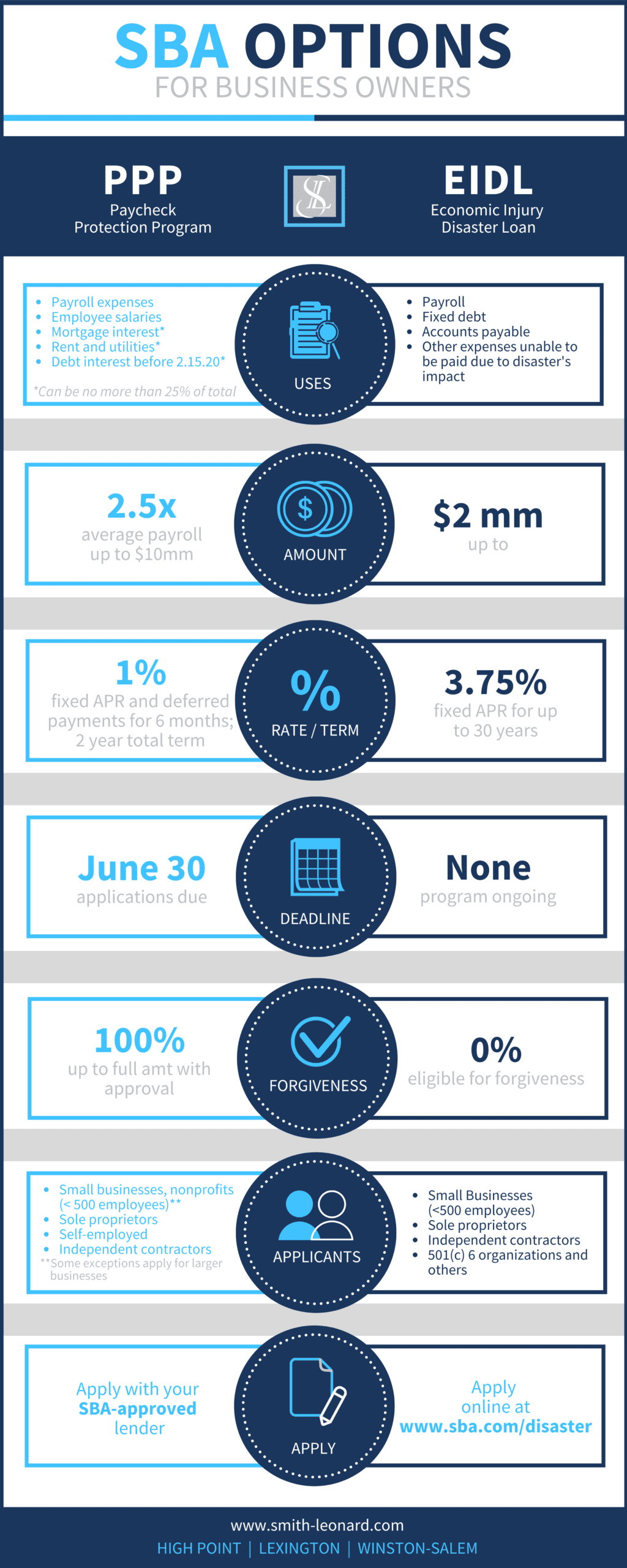

As a result of the CARES Act, a new loan program has been created called the Paycheck Protection Program (PPP). The CARES Act also substantially expands and alters a previously existing SBA loan, the Economic Injury Disaster Loan (EIDL), for a specified period of time. Access the PPP Application here. Click here as well for a quick PPP Fact Sheet.

As a result of the CARES Act, a new loan program has been created called the Paycheck Protection Program (PPP). The CARES Act also substantially expands and alters a previously existing SBA loan, the Economic Injury Disaster Loan (EIDL), for a specified period of time. Access the PPP Application here. Click here as well for a quick PPP Fact Sheet.

*Note that obtaining new debt through this program could impact any current debt agreements you have with your lender. Be sure to thoroughly review your debt covenants to ensure acquiring new debt will not trigger any unintended consequences for your business.

It should be noted that any business obtaining a PPP loan will be prohibited, under Section 2301(j) of the Act, to also benefit from the Employee Retention Credit available for those paying benefits under the Families First Coronavirus Response Act. Such businesses will also not be eligible for the deferral of payroll tax remittances as provided under the CARES Act. It is important that business owners understand which program or programs under the Act will be most beneficial to their business.

Who can help me with my loan?

Lenders may begin processing loan applications as soon as April 3, 2020. Smith Leonard has several SBA lender contacts in the marketplace and can help with recommendations, if needed.

- Contact any existing SBA 7(a) lender or any federally insured depository institution, federally insured credit union, and Farm Credit System institution that is participating

- Other regulated lenders will be available to make these loans once they are approved and enrolled in the program

- Consult with your local lender as to whether they are participating in the program

Bridging the Gap

We understand that having to wait for guidance to figure out how to qualify and apply for a loan can be very stressful with the world (and cash out) can be moving at lightening speed. While we believe the PPP will be a great resource for businesses, we acknowledge that many businesses need to make a decision today, or very soon, that will help them bridge the gap between now and when funds are available. In the meantime, one option is to furlough impacted team members and have them apply for unemployment. Once you receive the SBA funds, those furloughed employees can be hired back. By doing this, you can keep the number of employees during the 8 week period (starting on loan date) high relative to the denominator options (# of employees from 2/15/19 – 6/30/19, or 1/1/20 – 2/29/20). Ideally then, you are able to save on payroll costs in the interim when you do not have funds, but then can hire them back to take care of your people, ensure you have enough staff to get the job done, and also receive maximum loan forgiveness. Another option if in dire need is for companies to give 25% (or less) across the board pay cuts without jeopardizing any loan forgiveness. Ideally, you will have enough cash flow to not have to use the above options while waiting for SBA funds, but we wanted to offer some consideration points for those who feel they have no other choice.

PPP – Who Can Apply?

- Any small business with less than 500 employees (including sole proprietorships, independent contractors and self-employed persons), private non-profit organization or 501(c)(19) veterans organizations affected by coronavirus/COVID-19

- Businesses in certain industries may have more than 500 employees if they meet the SBA’s size standards for those industries

- Small businesses in the hospitality and food industry with more than one location could also be eligible at the store and location level if the store employs less than 500 workers. This means each store location could be eligible

Who is considered the applicant?

- For a sole proprietorship, the sole proprietor

- For a partnership, all general partners, and all limited partners owning 20% or more of the equity of the firm

- For a corporation, all owners of 20% or more of the corporation;

- For limited liability companies, all members owning 20% or more of the company

- Any Trustor (if the Applicant is owned by a trust).

What is required?

- Download a the PPP Application to see complete details

- Note that this information is changing rapidly, but based on communications with several SBA lenders in the area, we feel comfortable suggesting you have the following ready at application time:

- Business TIN (EIN, SSN)

- Complete copies, including all schedules, of the most recent Federal income tax returns for the applicant business (ideally 2019, if ready)

- State unemployment tax returns

- IRS Forms 940 and 941 (If you’re a PEO, you may not have these. See here.)

- 12 month payroll report for period beginning 1 year before the date of the application*

- 2019 profit and loss statement and balance sheet

- 12 month profit and loss statement beginning 1 year before the date of the application

- Articles of Incorporation, Organization, or Operating Agreement that list all owners with greater than 20% ownership stake

- Note: Each owner with 20% stake or greater:

- Must be a U.S. Citizen or have Lawful Permanent Resident Status

- Cannot be presently subject to an indictment, criminal information, arraignment, or other means by which formal criminal charges are brought in any jurisdiction; or presently incarcerated, on probation, or parole

- Cannot have, within the last 7 years, for any felony or misdemeanor for a crime against a minor: 1) been convicted; 2) pleaded guilty; 3) pleaded nolo contendere; 4) been placed on pretrial diversion; or 5) been placed on any form of parole or probation (including probation before judgment)

- In addition to the stipulations listed above for the 20% owner, if you can answer “yes” to either of these two questions, the loan will not be approved:

- Is the Business or any owner presently suspended, debarred, proposed for debarment, declared ineligible, voluntarily excluded from participation in this transaction by any Federal department or agency, or presently involved in any bankruptcy?

- Has the Business, any of its owners, or any business owned or controlled by any of them, ever obtained a direct or guaranteed loan from SBA or any other Federal agency that is currently delinquent or has defaulted in the last 7 years and caused a loss to the government?

- If you can answer yes to either of the following two questions, you will need to also provide more information on an appropriate addendum to the application:

- Is the Business or any owner an owner of any other business or have common management with any other business?

- Has the Business received an SBA Economic Injury Disaster Loan between January 31, 2020 and April 3, 2020?

*For purposes of calculating “Average Monthly Payroll”, most Applicants will use the average monthly payroll for 2019, excluding costs over $100,000 on an annualized basis for each employee. For seasonal businesses, the Applicant may elect to instead use average monthly payroll for the time period between February 15, 2019 and June 30, 2019, excluding costs over $100,000 on an annualized basis for each employee. For new businesses, average monthly payroll may be calculated using the time period from January 1, 2020 to February 29, 2020, excluding costs over $100,000 on an annualized basis for each employee. Questions on calculations? You’re not alone. See the issues that have emerged here.

We understand this process can be very overwhelming, and we are here to help. Contact your Smith Leonard representative with questions.