EXPERIENCE COUNTS

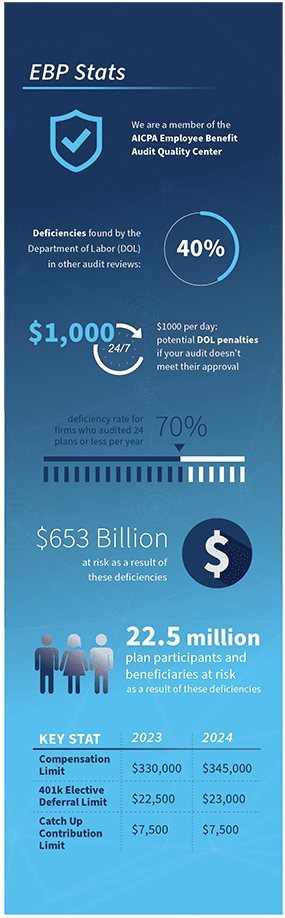

Smith Leonard is proud to perform over 100 employee benefit plan (EBP) audits each year with an experienced team empowered to facilitate an accurate, efficient, and cost-effective engagement.

Your company works hard to uphold your fiduciary responsibility to your employees. Don’t put yourself or them at risk by choosing the wrong provider. For your 401(k) and 403(b) plans and everything in between, Smith Leonard has an employee benefit plan team that is well-versed in all the nuances of these plan audits and is ready to help

Don’t put yourself or them at risk by choosing the wrong provider. For your 401(k) and 403(b) plans and everything in between, Smith Leonard has an employee benefit plan team that is well-versed in all the nuances of these plan audits and is ready to help

Our Employee Benefit Plan Group is able to assist clients with the following plan audits:

- 401(k) / Profit-Sharing

- 403(b)

- Employee Stock Ownership

- Defined Benefit / Pension

- Health & Welfare

- Limited & Full Scope Audits

Smith Leonard vs. The Other Options

- Dedicated and Experienced – Your service team will consist of professionals with deep knowledge and experience with employee benefit plan audits who dedicate a significant amount of their time each year to our EBP clients

- Current Guidance, Strong Resources – We value continuing education, receive specialized EBP (AICPA and NCACPA) training, and are trained in current ERISA, DOL and IRS regulations.

- Top Resources for You – We believe in extensive Partner, Director, and Senior Manager involvement. We never send our “B” team, and our leaders work with you beyond basic compliance to ensure the best advice and experience. When needed, we are able to go beyond our walls and call upon the resources of a global alliance.

Working with SL can prevent or correct the following operational errors or prohibited transactions:

- Incorrect understanding and implementation of the plan document

- Untimely remittance of participant contributions

- Misinterpretation of eligibility and vesting provisions

- Compliance failures

Contact our team to take advantage of our expertise:

- Mark Laferriere, Assurance Partner mlaferriere@smith-leonard.com

- Scotti Teschke, Assurance Partner steschke@smith-leonard.com

- Andrew Wright, Assurance Partner awright@smith-leonard.com

- Kayla Pollard, Assurance Manager kpollard@smith-leonard.com

Smith Leonard PLLC is a full-service, Triad-based CPA firm of approximately 100 associates who provide tax, audit, and advisory services to clients in a variety of industries and locations across the globe. We provide 401(k) audits and other related employee benefit plan audit services to clients throughout the Southeast, including Greensboro, High Point, Hickory, Winston-Salem, Lexington, and surrounding areas in the Piedmont Triad.